Re-inventing the application process in 16 weeks – Barclays account opening

Why make banking with us difficult? That was Barclays’ thinking when they looked at their online account opening process for new customers. The existing procedure was seen as long and disjointed, to the extent of putting potential customers off. Barclays needed to transform their account opening process to reduce the drop off rate and make the experience more personalised and rewarding.

Idea generation

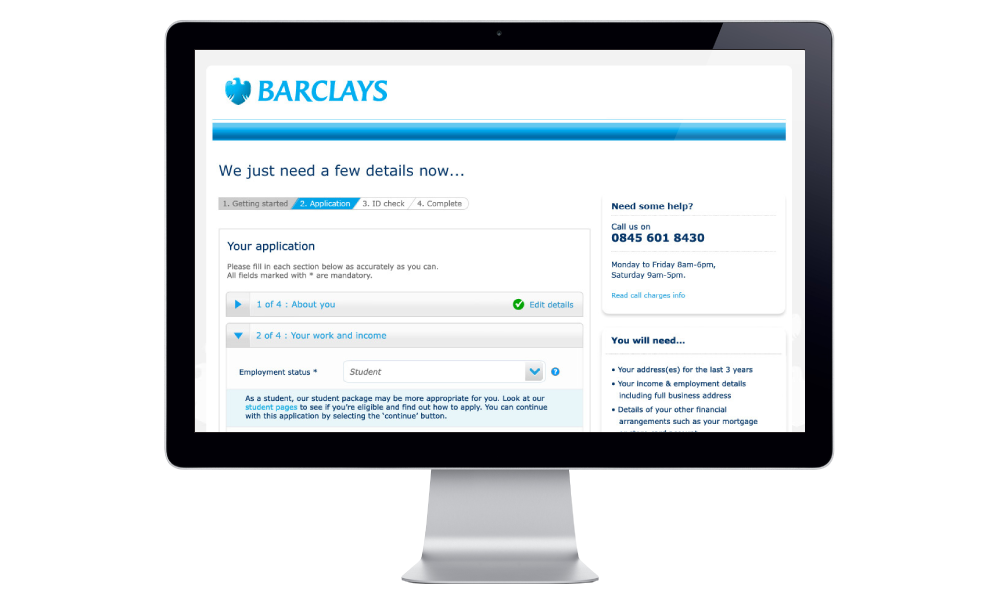

My team began the process by running a series of workshops with the client to understand the current process and brainstorm some ideas for the new process. Themed moodboards were used to help facilitate these ideas and introduce the client to thinking differently. From these workshops we established a set of interactive concepts to explore such as: lazy forms (minimum details upfront to customise and save the whole process); progressive disclosure (only giving the user the necessary information, disclosing new information as the user requires it); consistent progress bar; what you’ll need section at the start of the process; personalised forms; single page forms using accordions for progressive disclosure; and a consistent look and feel to form elements.

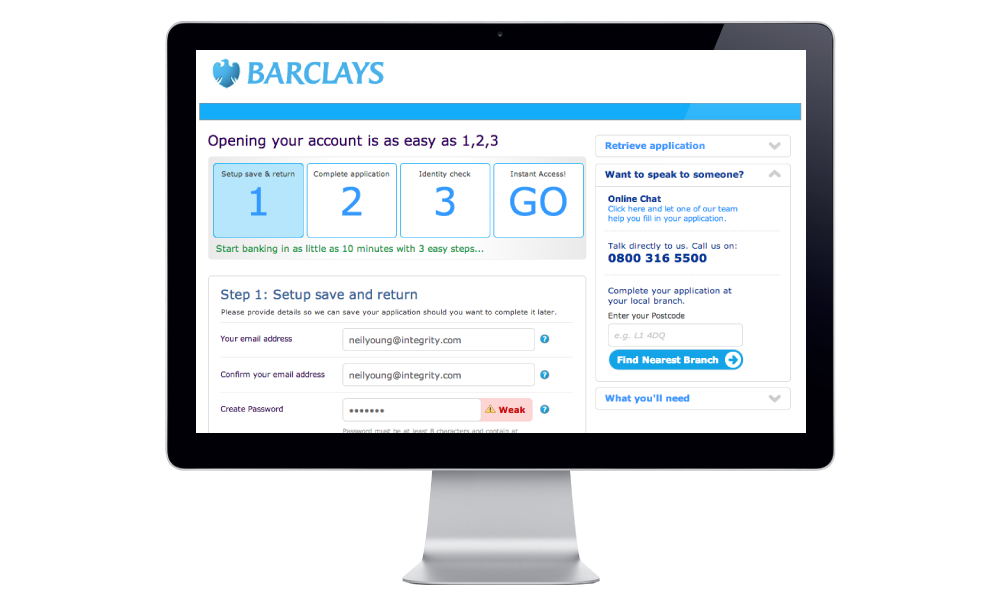

Prototype fast and early

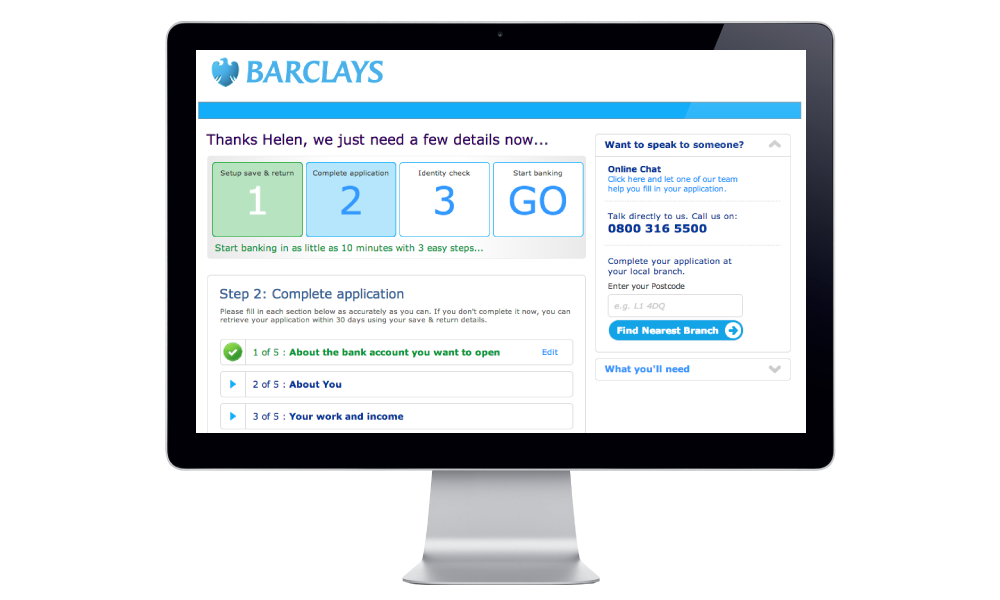

We quickly created a set of interactive wireframes to explore these possible solutions, testing ideas and confirming the right approach to explore. As the solution developed the fidelity of the wire frames increased to create a like-for-like prototype built using real code (front-end only) for the entire experience. This enabled the client to experience the full application process within two weeks from the start of the project. The new process was very well received and after a small number of amends, the prototype was tested by real users before becoming the starting point for the development team to build upon.

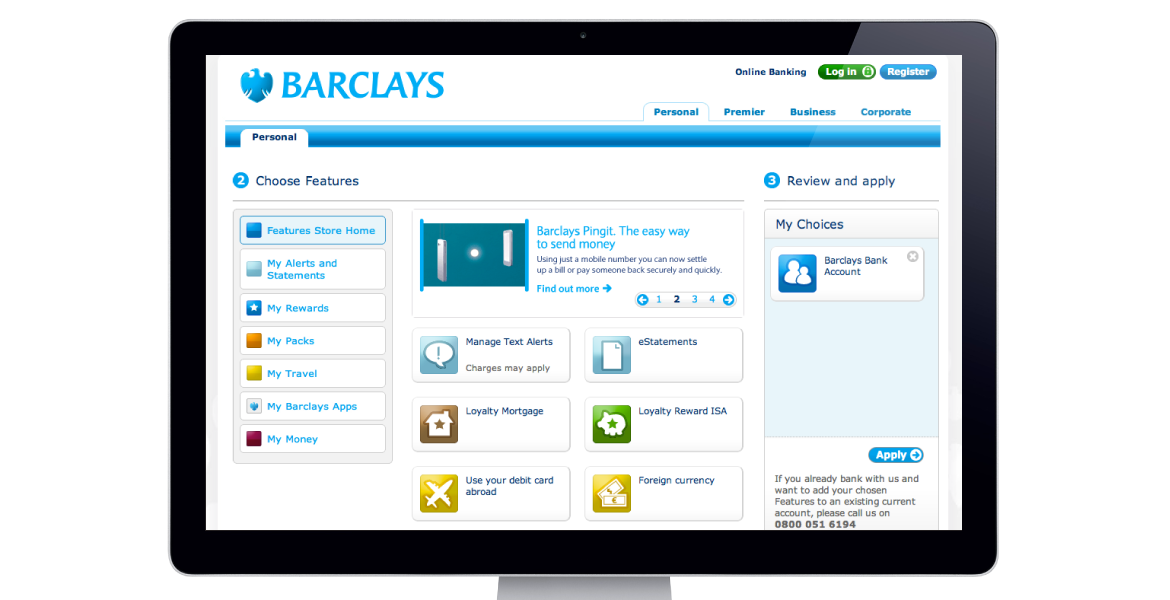

New thinking, the Barclays Features Store

The new process worked well, however it still felt like a traditional application process, although quicker it didn’t feel rewarding and personal enough. We conceived the idea for ‘Features Store’ which enabled new customers to customise their account features before progressing onto the full application process. The idea was quickly prototyped and presented to the client, and within two weeks was integrated with both the final application process and also the current online banking experience and delivered within the original timescale.

The result

In only 16 weeks we designed and built an entirely new process. This totally transformed the user experience, with a significantly lower drop off rate. Now it incorporates a new layout, lazy forms and progressive disclosure to reduce the number of steps, taking just minutes to complete. The introduction of the ‘Features Store’ concept has also given Barclays a ground-breaking differentiator against the other retail banks making the application process much more personalised and rewarding. In the initial weeks after the launch of ‘Features Store’ Barclays saw a considerable increase in applications and the sale of account extras such as insurance products.

Radical are more than just a digital agency,

they are a key partner in shaping and delivering our digital innovation agenda across all our customer touch points.

Juan Saenz de Santa Maria Global Director – Retail Banking

Following this achievement, my team successfully delivered over 20 new digital products with Barclays across web, mobile, tablet, social media, digital kiosk and cloud computing.