Surveys are great for quickly collecting large amounts of data about your users. At Envato, our design team creates surveys so we can gain valuable insight about the way people use our product.

But preparing a great survey is challenging—writing good questions takes time, and the results can often be disappointing.

Here’s how we used to create surveys: we’d jump straight into writing questions. Our colleagues and stakeholders would give us feedback on the questions without a true understanding of who the survey was for or what we wanted to learn.

Before long we’d have a 20-question, difficult-to-complete monster survey. The results would be just as bad: difficult to understand, with no clear insight.

Surveys are useless until you know who it’s for and what you want to learn from it.

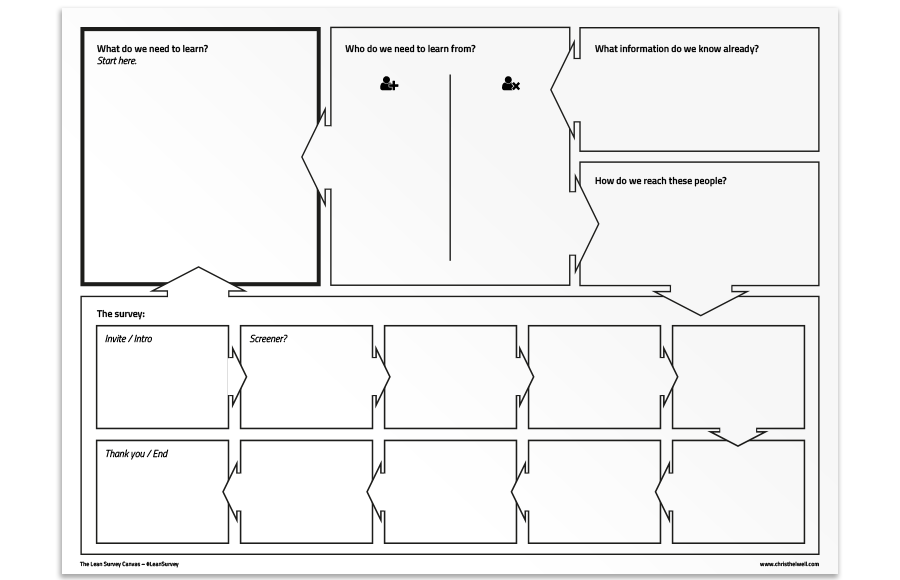

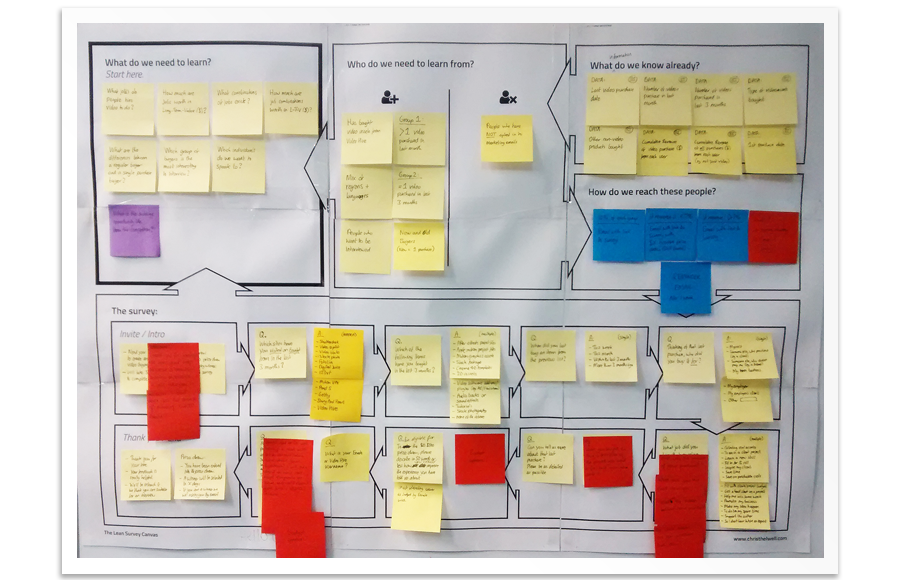

So we created The Lean Survey Canvas to help us prepare better surveys faster (in just a few hours). It allows everyone to collaborate around a single source of truth with all of the information at hand. We now focus on the insight we need or validating our hypotheses rather than writing questions. The result is a more concise survey (under 8 questions) that’s much easier for the participant to complete with clear, actionable insight from the results.

Download The Lean Survey Canvas template here.

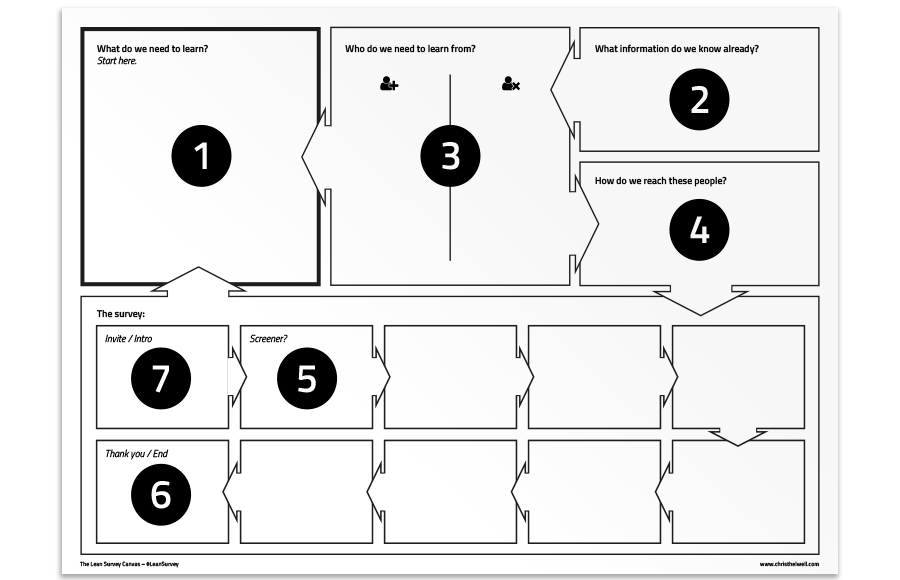

How to use the canvas in 7 steps

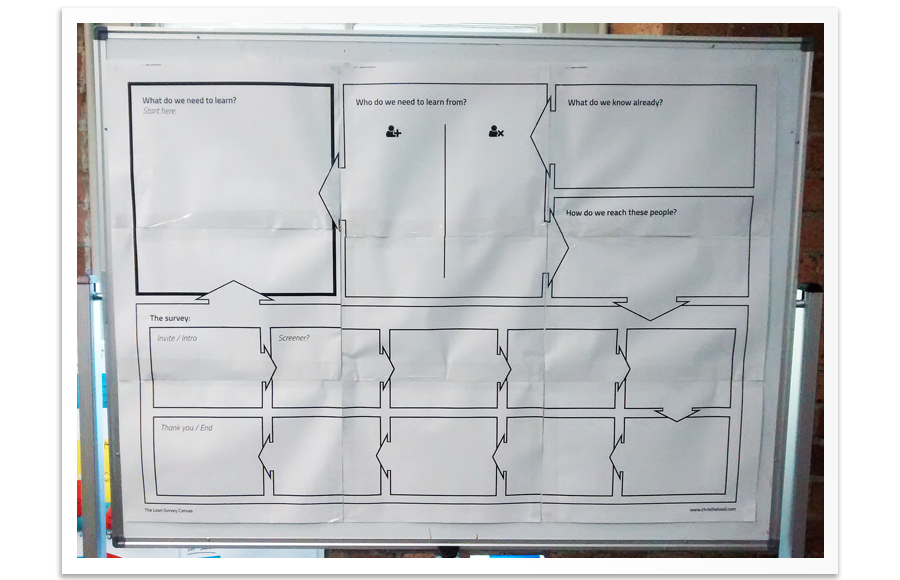

The canvas is a non-digital process designed to evolve a great survey in a fast, lean, and iterative way. It’s best completed as a group (make sure you include all the important stakeholders), but you can also work on it by yourself.

Print the canvas out as large as you can and stick it on a wall. You’ll need Post-it notes and spare sheets of paper to allow you to move things around and adapt as you explore the survey.

Follow the order indicated in the diagram above. You’ll find yourself jumping back and forth as you discover new ideas and discard previous ones. Avoid writing any question until you’re happy with the flow of the whole survey—you’ll find that most of the questions you come up with aren’t needed.

You’ll find most survey questions you come up with aren’t needed.

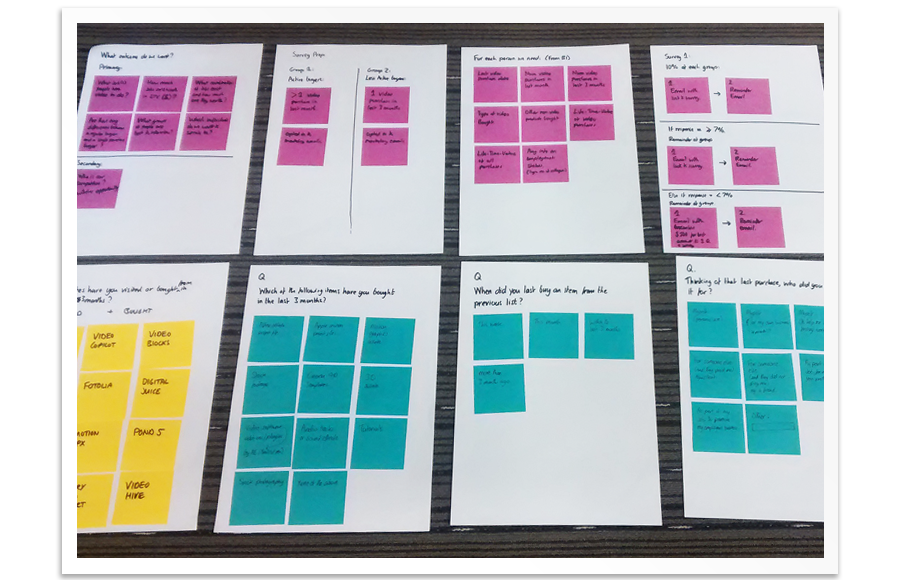

Pro tip: Start by writing notes for each section on separate sheets of paper (allowing you to create as many ideas as possible) before mapping it out onto the canvas itself.

Strategic versus Tactical?

Before you start, decide if your survey will be strategic or tactical—otherwise you won’t get the results you need.

A strategic-focused survey helps you build a better picture of your user and enables you to make better decisions about the future of your product or service.

You won’t get the results you need unless you decide if your survey is strategic or tactical.

A tactical survey answers the question “What should we build next?”

It’s worth asking all the stakeholders involved about what output they need from the survey results.

1. What do we need to learn?

This is the most important part of the survey, and the answers to all the other sections on the canvas should relate back to this. You can use questions or assumptions here or a mix of both. To help you decide, consider the output you need from the survey and how it’ll be used.

To complete this section, we use the 4 “what do we know?” questions:

- What do we know we know? Do we need to confirm any of our existing knowledge?

- What do we know we don’t know? What questions do we need to ask to find out the unknowns?

- What don’t we know that we know? What assumptions do we have that we could validate?

- What don’t we know that we don’t know? Who should we speak to to find out more?

An example: the design team at Envato uses a couple of survey formats more than others. We use a Jobs-To-Be-Done survey to find the right kind of people we need to interview and an Outcome-Driven Innovation survey to tactically discover the right features to build next. In our Jobs-To-Be-Done survey we seek to validate our assumptions about the jobs our users hire our product for and discover who the interesting users are that we want to interview (those with the best stories).

2. What information do we know already?

These could be answers to the questions from step 1 that you already know, information about the recipients that we don’t have to ask, or data that helps give more context and value to the results. This information typically comes from:

- Previous survey results

- Previous qualitative studies

- Analytics data

- Existing user database

Ask what you need to do to get this information and create actions to get it.

Pro tip: Use a different colour Post-it note for recording these actions on the canvas.

Another example: by adding data such as Life-Time-Value or revenue per customer to the results of the survey, we can see which people to invite for interviews based on their value as customers.

3. Who do we need to learn from?

Next we need to define the people who will complete our survey. List out the characteristics of the ideal participant, plus a list of the types of people you don’t want. For instance, you may need a regular or a new buyer, but you may want to avoid people you’ve already surveyed or those who haven’t opted in to emails.

4. How do we reach these people?

Now we have an idea who we want to send the survey to, we need to figure out how we’ll get it to them. There are lots of ways this can be done, including:

- An email list to your users

- Featured survey promotion in your product

- Following certain actions within a process

- Google Adwords

- Using a paid-for survey tool

Make a note of the channel you think will reach the people you need. Also consider things like incentives or any split tests you want to do and details like timing and reminders.

Pro tip: We use Post-it notes in different colours to show any actions like getting a list of users with the right attributes created.

5. The questions

Now for the hard part. But thanks to all the sections you’ve already completed, it should be much easier. If you didn’t generate lots of ideas while going through the previous steps, take some time now to brainstorm as many questions as you can.

- Create as many different questions as you can—time-box this so you don’t take too long.

- Group the questions based on how they relate to the main learnings (the ones you created in step 1).

- Go through each group, and ask ‘does it answer one of the questions set out in step 1?’ Get rid of those that don’t. If it answers more than one, see if it’s possible to split the question. It’ll be easier to understand the results if each survey question relates to a single learning.

- Any learnings missing from step 1? Try to get some ideas for every answer.

- Write a single question for each group. You’ll need to combine and rewrite questions again and again to make sure you get the most out of each question.

- Do you need a screener question? To help clarify that you have the right people answering the questions. (You created this in step 3).

- Do you need to capture important information (eg their contact details if you need to get in touch with them)?

- Order the questions so they tell a story. This will help the recipients complete the survey easily as it builds on the detail as they go through it.

- Aim for about 6 or 7 questions in total. Any more and you’ll see a much lower completion rate.

Order survey questions so they tell a story.

Now you’re ready to start writing the final version of the questions, and add any answer options:

- Start adding all the answers for single or multiple choice questions

- Try not to write the obvious—think of the answer from the participant’s point of view

- Check ‘does this answer the real question from step 1.’ If it doesn’t, get rid of it or rewrite it

An example: we wanted to know if our buyers bought from us as freelancers or as part of their job, and if there was a client involved. Once we’d written the obvious question and answers, we challenged whether it made sense, if it was easy to answer, and if it really answered the question we had. We rewrote the whole question to focus on whether people bought for themselves or their employer and if someone else paid for what they bought.

Check, does this answer the real question

6. Thank you

Next you need to write the ending to your survey. This is the message the participant sees after completing all the questions and giving you the insight you really value. So don’t forget to thank them and let them know what you’ll do with their information. You’ll also need to include any details of the incentive, if you offered one.

7. Invite / Intro

Write your intro last so you can prepare the participant for the tasks ahead. You need to include information such as:

- How long the survey will take to complete

- Why you’re asking for the information

- What you’ll use the information for

- If you’ll be asking any sensitive questions or for personal details

- Any details about an incentive

Review and iterate

As a group, you’ve created your canvas. So now go back through and make sure it makes sense. Ask someone who isn’t part of the group to take a look through the canvas and check with them that the survey answers the questions set out. Iterate a few times to get it just right—that’s why we used Post-it notes!

Getting the survey out

Now you’re ready to send your survey out to your participants. However, first you’ll probably want to get it written by a copywriter in the correct tone of voice. You may also want to test the survey internally. Tools like Google forms are perfect for these quick tests. If you make any changes, make sure to update the canvas.

Next, it’s time to set the survey up and send it out. Survey tools like Typeform, Formstack, or Survey Monkey make creating surveys quick to set up and easy to send. When choosing a tool, consider how the data comes back from the survey—not just how good the survey looks.

We focus on the insight we need rather than writing questions.

Conclusion

With The Lean Survey Canvas you now have a great tool for creating surveys collaboratively and quickly. It’ll help you get a survey ready in just a few hours, with the whole team sharing the same context. The canvas becomes an information radiator to use before, during, and after the survey, giving it a clear purpose which can be measured by the output it collects.

Ready to give it a try? Download The Lean Survey Canvas template and let me know how you get on. #LeanSurvey

This article was first published on InVision Blog: How to quickly create a powerful survey.